Action required: Please refresh your browser

We have recently implemented some changes that require a hard refresh of your browser: Please hold down the CTRL-key and press the F5 key.

After a successful hard refresh, this message should not appear anymore.

More details about this topic are available here »

| Preliminary Results for the Year Ended 31 December 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| By: GlobeNewswire - 19 Apr 2024 | Back to overview list |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

19 April 2024 Biodexa Pharmaceuticals PLC Preliminary Results for the Year Ended 31 December 2023 Biodexa Pharmaceuticals PLC (NASDAQ: BDRX), a clinical stage biopharmaceutical company developing a pipeline of products aimed at primary and metastatic cancers of the brain, announces its audited preliminary results for the year ended 31 December 2023. For more information, please contact:

About Biodexa Pharmaceuticals PLC Biodexa Pharmaceuticals PLC (listed on NASDAQ: BDRX) is a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs. The Company’s lead development programmes include tolimidone, under development as a novel agent for the treatment of type 1 diabetes and MTX110, which is being studied in aggressive rare/orphan brain cancer indications. Tolimidone is an orally delivered, potent and selective inhibitor of Lyn kinase. Lyn is a member of the Src family of protein tyrosine kinases, which is mainly expressed in hematopoietic cells, in neural tissues, liver, and adipose tissue. Tolimidone demonstrates glycemic control via insulin sensitization in animal models of diabetes and has the potential to become a first in class blood glucose modulating agent. MTX110 is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the tumour, by-passing the blood-brain barrier and potentially avoiding systemic toxicity. Biodexa is supported by three proprietary drug delivery technologies focused on improving the bio-delivery and bio-distribution of medicines. Biodexa’s headquarters and R&D facility is in Cardiff, UK. For more information visit www.biodexapharma.com. Forward-Looking Statements Certain statements in this announcement are forward-looking statements or information (collectively, forward-looking statements). Biodexa hereby provides cautionary statements identifying important factors that could cause the actual results to differ materially from those projected in the forward-looking statements. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “may”, “is expected to”, “anticipates”, “estimates”, “intends”, “plans”, “projection”, “could”, “vision”, “goals”, “objective” and “outlook”) are not historical facts and may be forward-looking and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes may not occur or may be delayed. The risks, uncertainties and other factors many of which are beyond the control of Biodexa, that could influence actual results include, but are not limited to: a limited operating history; regulatory risks; substantial capital and liquidity requirements; financing risks and dilution to shareholders; competition; reliance on management and dependence on key personnel; conflicts of interest of management; exposure to potential litigation, and other factors beyond the control of Biodexa. Forward looking statements are based on estimates and assumptions made by management in light of their experience of historical trends, current conditions and expected future developments, as well as factors that are believed to be appropriate. Such factors include, among others, Biodexa’s future product revenues, stage of development, additional capital requirements, risks associated with the completion and timing of clinical trials and obtaining regulatory approval to market Biodexa’s products, the ability to protect its intellectual property, dependence upon collaborative partners, changes in government regulation or regulatory approval processes and rapid technological change in the industry. These factors should be considered carefully and readers are cautioned to not place undue reliance on such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, Biodexa undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all such factors and to assess in advance the impact of each such factor on the business of the Company or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. You should, however, review the factors and risks we describe in the reports we will file from time to time with the US Securities and Exchange Commission after the date of this announcement. As a result of these factors, we cannot assure you that the forward-looking statements in this announcement will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

Headquartered in Cardiff, UK, with its American Depositary Shares (“ADSs”) quoted on the NASDAQ exchange in the US, Biodexa is a clinical-stage biotechnology company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs including Type 1 diabetes and rare / orphan brain cancers. The Company de-listed from the AIM market as of 26 April 2023. STRATEGY In the course of seeking additional funding for the Company, it became clear that raising significant funds for a drug delivery platform company was going to be difficult, if not impossible, in the then prevailing financial markets. Accordingly, we decided to re-position the Company as a therapeutics company and began looking for assets to complement our MTX110 programmes. Following the re-positioning of the Company, our priorities for 2024 reflect our modified strategy as follows:

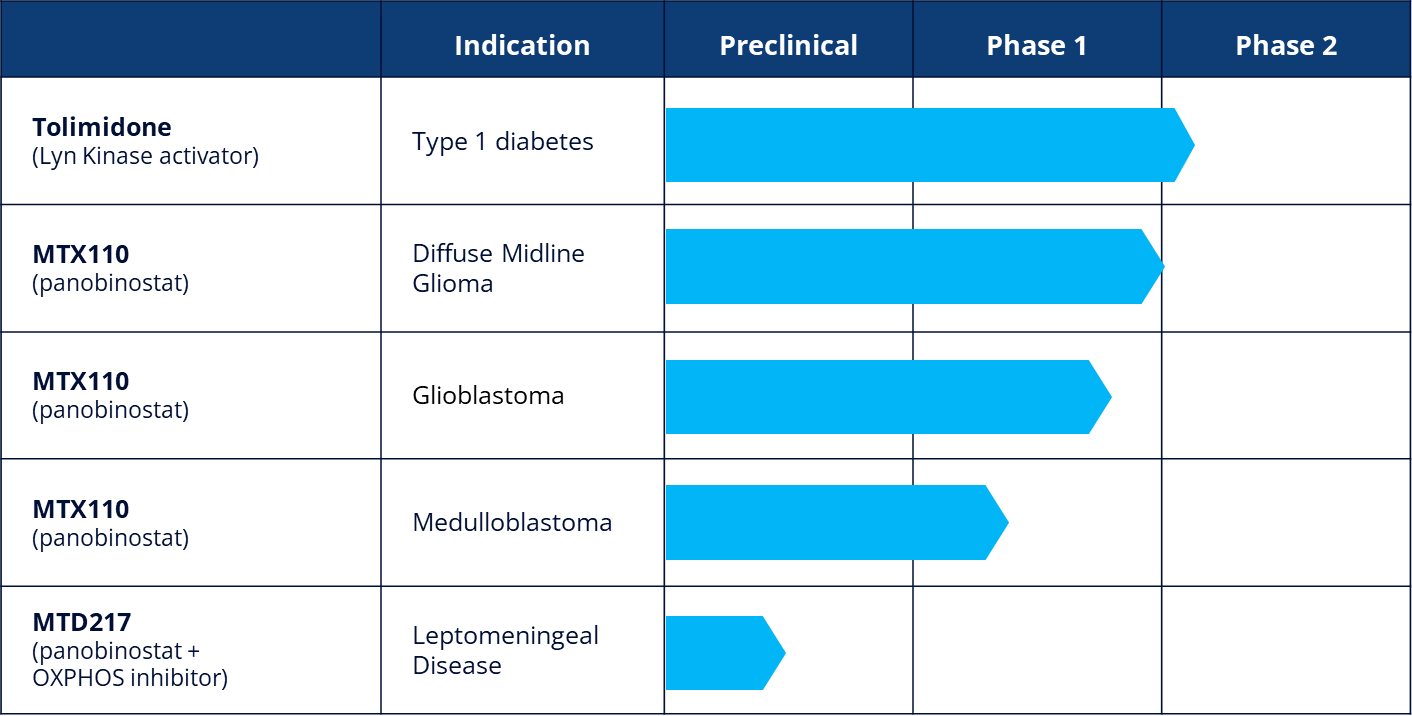

BUSINESS MODEL In order to make the Company more investable and secure additional financing, the Board decided to re-position the Company as a therapeutics (as opposed to drug delivery) company in early 2023. As a result, the delivery of proof-of-concept clinical data is the primary focus of our business model going forward. Development Our intention is to build a balanced portfolio of clinical-stage development assets, ideally with a focus on rare / orphan indications. Tolimidone, which was in-licensed in December 2023, is a Phase II ready asset which we intend to develop for Type 1 diabetes. MTX110 is currently in Phase I development for three rare / orphan brain cancers. Our aim is to develop our clinical assets to proof of concept stage before securing partners to undertake the most expensive, later stage development. Manufacturing We do not intend to establish our own manufacturing capabilities. For clinical trial material we utilise GMP-certified contract manufacturers. Commercialisation Once proof-of-concept has been established, we intend to seek to license our products to a partner who would complete the clinical development and subsequently market and sell them in the licensed territory. In addition to reimbursement of development costs, the partner would be expected to make milestone payments based on sales targets and royalty payments. Our development pipeline now includes five projects, four of which are at clinical stage, as follows:

CLINICAL-STAGE ASSETS Tolimidone Tolimidone was originally discovered by Pfizer Inc. (“Pfizer”) and was developed through Phase II for the treatment of gastric ulcers. Pfizer undertook a broad pre-clinical program to characterise the pharmacology, pharmacokinetics, metabolism and toxicology of tolimidone. Pfizer discontinued development of the drug due to lack of efficacy for that indication in Phase II. Tolimidone is a selective activator of the enzyme Lyn kinase which increases phosphorylation of insulin substrate -1, thereby amplifying the signalling cascade initiated by the binding of insulin to its receptor. We intend to develop tolimidone for the treatment of Type-1 diabetes (“T1D”). As a Lyn kinase activator, tolimidone has been shown in preclinical experiments to have a role in beta cell survival and proliferation. If replicated in clinical studies, tolimidone could have the potential to be disease modifying and change the treatment paradigm for T1D. T1D affects approximately 8.4 million people worldwide and there are approximately 500,000 new diagnoses per annum. As a first step in the planned continued clinical development of tolimidone, we intend to initiate a Phase IIa dose confirmation study to establish the optimum dose of tolimidone in patients with T1D. The Phase IIa study will be open-label in approximately 15 patients with T1D treated over a period of three months with endpoints of change in C-peptide levels, HbA1c and number of hyperglycaemic events. MTX110 Using our MidaSolve technology in combination with panobinostat, an otherwise insoluble drug, MTX110 is designed for direct-to-tumour administration via a catheter system (Convection Enhanced Delivery, or "CED") thereby bypassing the blood-brain barrier and allowing for high drug concentrations and broader drug distribution in and around the tumour while simultaneously minimising systemic toxicity and other side effects. Panobinostat is currently marketed under the brand Farydak® which is used orally in combination therapy for the treatment of multiple myeloma. We are currently researching the utility of MTX110 to proof of concept stage in three indications: Glioblastoma Multiforme (GBM): During 2023 we completed recruitment of patients in the first cohort of a Phase I study to assess the utility of MTX110 in recurrent GBM. The Phase I study is an open-label, dose escalation study designed to assess the feasibility and safety of intermittent infusions of MTX110 administered by convection enhanced delivery (CED) via implanted refillable pump and catheter. The study aims to recruit two cohorts, each with a minimum of four patients; the first cohort received MTX110 only and the second cohort will also receive MTX110 but, at the option of the treating clinician, the catheter may be re-positioned once recurrence occurs. Diffuse Midline Glioma (DMG), formerly known as Diffuse Intrinsic Pontine Glioma, or DIPG: In October 2020, we reported the first-in-human study by the University of California, San Francisco (“UCSF”) of MTX110 in DIPG using a convection enhanced delivery (“CED”) system. The Phase I study established a recommended dose range for Phase II, a good safety and tolerability profile but also encouraging median survival data of 26 months in the seven patients treated. An additional Phase I Investigator Initiated Trial by Columbia University is expected to report data in 2Q24. Thereafter, we intend to explore the possibility of seeking an IND for a Phase II study of MTX110 in DMG. The University of Texas is undertaking a Phase I exploratory study in recurrent medulloblastoma patients using direct administration of MTX110 into the fourth ventricle, enabling it to circulate throughout the central spinal fluid. PRECLINICAL ASSET MTD217 (1) American Association of Neurosurgeons (2) Radke et al (2019). Predictive MGMT status in a homogeneous cohort of IDH wildtype glioblastoma patients. Acta Neuropathologica Communications 7:89 Online: https://doi.org/10.1186/s40478-019-0745-z (3) J Neurooncol. 2017; 135(1): 183–192 (4) Louis DN, Ellison DW, et al. The 2016 World Health Organization Classification of Tumors of the Central Nervous System: a summary. Acta Neuropathol 2016; 131:803–820 (5) Jansen et al, 2015. Neuro-Oncology 17(1):160-166 (6) Aboian et al (2018). Neuro-Oncology Practice, Volume 5, Issue 4, December 2018 (7) Smoll NR (March 2012). "Relative survival of childhood and adult medulloblastomas and primitive neuroectodermal tumors (PNETs)". Cancer. 118 (5): 1313–22 (8) https://my.clevelandclinic.org/health/diseases/22737-leptomeningeal-disease CHIEF EXECUTIVE’S REVIEW Introduction With the backdrop of a continued difficult market for financing biotech companies, 2023 was again dominated by efforts to re-finance the Company and bring in additional clinical-stage assets into the development pipeline to diversify risk, enhance news flow and provide more opportunities for success. R&D Update Tolimidone In T1D, the body’s immune system attacks pancreatic beta cells such that they can no longer produce insulin which is required to regulate plasma glucose levels. The causes of T1D are not fully understood and there is currently no cure. Patients with T1D are dependent on daily administration of insulin (via injection or infusion). Tolimidone is a Lyn kinase activator and its potential utility in T1D was first demonstrated by several ground-breaking preclinical studies conducted at the University of Alberta, where Lyn kinase was identified as a key factor for beta cell survival and proliferation in in vitro and in vivo models. Tolimidone was shown to both prevent beta cell degradation and to stimulate beta cell proliferation. As soon as we closed the in-license of tolimidone we began preparing for a Phase IIa dose confirming study which is expected to begin recruitment in the second quarter of 2024. The Phase IIa study will be open-label and include three doses with approximately 15 patients studied over three months with a follow up period. End points are expected to include C-peptide levels (a marker for insulin), HbA1c levels (a marker for plasma glucose) and number of severe hyperglycaemic events. Thereafter, we expect to follow up by a double-blind, placebo-controlled Phase IIb study in approximately 40-45 patients with similar clinical endpoints. MTX110 We initially began developing MTX110 for DMG, the ultra-rare, highly aggressive and inoperable form of childhood brain cancer. In February 2024 we announced the results of a Phase I study conducted by Columbia University Irving Medical Center. As this was the first ever study of repeated infusions to the pons via an implanted CED catheter, the primary objective of the study was safety and tolerability and, accordingly, the number of infusions was limited to two, each of 48 hours, 7 days apart. Nine patients were treated in the study (30 M group, n=3; 60 M group, n=4; 90 M group (optimal dose), n=2). One patient in the 60 M group suffered a severe adverse event assessed by the investigators as not related to the study drug but related to the infusion and tumour anatomy. Although the study was not powered to reliably demonstrate efficacy, median overall survival (OS) of patients in the study was 16.5 months. MTD217 Financings Private Placement, February 2023 Registered Direct Offering, May 2023 Registered Offering, December 2023 De-listing from AIM Following shareholder approval at a General meeting on 24 March 2023, the Company was de-listed from the AIM market with effect from 26 April 2023. The Board decided to recommend cancelling the Company’s AIM listing for a number of reasons including: an increasingly smaller proportion of trading in the Ordinary Shares is conducted on AIM compared to NASDAQ ; improved liquidity through concentration of trading in the Company’s securities on a single market; and, the cost, management time commitment and the burden of complying with the AIM Rules and maintaining a quotation on AIM is duplicative of that for complying with the NASDAQ rules. In addition, as was demonstrated with the in-licensing of tolimidone, we intend to seek opportunities to expand our pipeline through the acquisition and / or in-licensing of additional development programmes. Given our market capitalisation, most transactions are likely to be deemed reverse takeovers under AIM rules, requiring suspension and re-listing via a new Admission Document which is both time-consuming and costly. Change of Name Our intention is that re-positioning as a therapeutics company should represent a “fresh start” for the Company. To reflect this change the Company’s name was changed to Biodexa Pharmaceuticals PLC following a General Meeting on 24 March 2023. Outlook Taking into account the $15.3 million (gross) we raised in 2023, we have the resources to deliver two sets of preclinical data and three sets of clinical data in 2024. Our development pipeline now includes five programs, of which four are at clinical stage. With the pipeline stronger than it has ever been, we are enthusiastic about the potential for our Company in 2024 and beyond. FINANCIAL REVIEW Introduction Biodexa Pharmaceuticals PLC (the "Company") was incorporated as a company on 12 September 2014 and is domiciled in England and Wales. Financial analysis Key performance indicators

Revenue In the year ended 31 December 2023, Biodexa generated consolidated total gross revenue of £0.38m (2022: £0.70m), a decrease of 46% on the prior year, this arose from customer revenue as in 2022. Customer revenue was derived entirely from the Group’s R&D collaboration agreements with Janssen in both years which has now ceased. Research and development expenditure Research and development costs were £4.07m, a reduction of £1.04m, or 20% on 2022 (2022: £5.11m). The percentage of R&D costs as a percentage of operating costs also reduced to 48% from 53% in the prior year. The reduction in the year reflects the Directors decision to reposition as a therapeutics company and to not expand our internal drug delivery platform, resulting in a reduction in pre-clinical expense of £0.87m. Personnel costs also reduced by £0.39m as a result of the cost reduction program in March 2023 where eight staff members were made redundant at a one-time cost of £105k. Expenditure on the MTX110 clinical program increased during the year by £0.41m offsetting in part the reduced expense on pre-clinical programs and staffing. Administrative costs Administrative costs in the year reduced by £0.2m to £4.34m (2022: £4.54m). During the year the Company expensed £1.31m on legal and professional fees in connection with the successful financing transactions in the year, the acquisition of the tolimidone licence in December 2023 and aborted acquisitions, this compares to £1.36m spent in 2022 on the aborted acquisition of Bioasis Technologies Inc (“Bioasis”). During the year the Company provided a loan to Adhera Therapeutics, Inc. (“Adhera”) of £0.08m, which was forgiven on completion of the acquisition of the global rights to develop and commercialise tolimidone in December 2023 transaction. Staff costs During the year, the average number of staff decreased to decreased to 21 (2022: 27), reflecting the cost reduction program undertaken in March 2023. Total staff cost reduced 19% to £2.06m (2022: £2.52m). Taxation During 2023 and 2022 we recognized U.K research and development tax credits of £0.41m and £0.83m in respect of R&D expenditure incurred. The lower tax credit in the current year is due to the reduced R&D spend compared to 2022. Capital expenditure Purchase of tangible fixed assets in 2023 was £0.03m (2022: £0.06m) and related to investment in laboratory equipment. In addition, in December 2023, the Company purchased an intangible asset being the global rights to develop and commercialise tolimidone for total consideration of £2.94m, this was satisfied £0.24m in cash and £2.70m by the issue of ordinary shares and pre-funded warrants. Cash flow Net cash outflow from operating activities in 2023 was £6.83m (2022: outflow £7.05m) driven by a net loss of £7.08 (2022: loss £7.66m) and after negative movements in working capital of £0.05m (2022: positive £0.52m), taxes received of £0.84m (2022: £0.68m), and other net negative adjustments for non-cash items totalling £0.54m (2022: negative £0.59m). Investing activities outflow in 2023 of £0.27m (2022: outflow of £0.22m) included purchases of property, plant and equipment of £0.03m (2022: £0.06m), purchase of tolimidone licence for total consideration of £2.94m including cash of £0.24m. These cash outflows are offset interest income from bank deposits of £0.07m (2022: £0.03m). Financing activities inflow in 2023 of £10.23m (2021: inflow of £0.05m) was driven by receipts from share issues of £10.43m (2022: £0.24m). The other principal outflows related interest paid of £0.01m (2022: £0.02m) and payments on lease liabilities of £0.19m (2022: £0.18m). As a result of the foregoing, net cash inflow for the year was £3.14m (2022: outflow of £7.22 m). Share consolidation and ADS Ratio At a General Meeting on 24 March 2023, shareholders approved a consolidation of the Company’s Ordinary Shares on a one for 20 basis. As a result the par value of the Ordinary Shares was changed from £0.001 per share to £0.02 per share. At the same time, the ratio of the Company’s Ordinary Shares to ADSs was changed from each ADS representing 25 Ordinary Shares to each ADS representing 5 Ordinary Shares. At a General Meeting on 14 June 2023, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of £0.02 each into to one Ordinary Share of £0.001 each and 19 ‘B’ Deferred Shares of £0.001 each. The ‘B’ Deferred Shares have limited rights and are effectively valueless. On 5 July 2023 the Company affected a change in the ratio of the Company’s Ordinary Shares from each ADS representing 5 Ordinary Shares to each ADS representing 400 Ordinary Shares. Going Concern – material uncertainty The Group and Company has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the year ended 31 December 2023, the Group incurred a consolidated loss for the year of £7.08m and negative cash flows from operations of £6.83m. As of 31 December, 2023, the Group had an accumulated deficit of £142.82 m. The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until milestones and/or royalties can be secured from partnering the Company’s assets. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies. The Directors believe there are adequate options and time available to secure additional financing for the Company and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements. The Group's consolidated financial statements have therefore been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As at 31 December 2023, the Group had cash and cash equivalents of £5.97m. The Directors have prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months from the date of approval of the consolidated financial statements. These forecasts show that further financing will be required before the fourth quarter of 2024 assuming, inter alia, that certain development programs and other operating activities continue as currently planned. If the Company does not secure additional funding before the fourth quarter of 2024, it will no longer be a going concern and would likely be placed in Administration. Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected. If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares (including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly harm our business, financial condition and prospects. In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies remains challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any alternative courses of action to finance the Company would be successful. This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group and Parent Company’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Company which are actionable before its cash resources run out then the Company will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities. Macro-economic environment The invasion by the Russian Federation military in Ukraine in early 2022 and the recent Israeli/Palestinian conflict in the Middle East has had a destabilising impact on the global economy. Although there has been no immediate impact on the Group, it is not possible to assess the medium- and long-term impact of these conflicts on the Group and the global economy generally. As at 31 December 2023 the Group had 16 employees, of whom 10 were routinely based at its offices in Cardiff, Accordingly the Company believes it has a relatively modest environmental impact. All materials imported into the Company’s laboratories are assessed for safety purposes and appropriate handling and storage safeguards imposed as necessary. Any small quantities of hazardous materials are removed by licensed waste management contractors. A number of policies and procedures governing expectations of ethical standards and the treatment of employees and other stakeholders are set out in the Company’s Employee Handbook. The Company has also established an anti-slavery policy pursuant to the Modern Slavery Act 2015. The Company strives to be an equal opportunity employer, irrespective of race or gender. At 31 December 2023, the number of male/female employees was 31%/69%, the number of male/female senior managers was 67%/33% and the number of male/female Directors was 80%/20%. Annual greenhouse gas emissions We measure our environmental performance by reporting our carbon footprint in terms of tonne CO2 equivalent. We report separately on our indirect emissions from consumption of electricity (Scope 2) and emissions consisting of employee travel in cars on Group business estimated on the basis of miles travelled (Scope 3). The Group have elected to monitor and report its energy efficiency using tonnes of CO2 per employee as an intensity ratio. Methodology In calculating the reported energy usage and equivalent greenhouse gas emissions the Group have referred to the HM Government Environment Reporting Guidelines and the GHG Reporting Protocol. A location-based allocation methodology was used to calculate electricity usage.

The Group’s electricity costs for 2023 were approximately £30,000 (2022: £23,000). The kWh usage in the year was 87,780 (2022: 78,017). The Group has no immediate plans to improve energy efficiency. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended 31 December

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||